Norway’s huge sovereign wealth fund fueled by oil revenues reached more dizzying heights last year, also in the midst of the Corona crisis. It now tops an international list as the biggest in the world, despite the government’s biggest withdrawals ever to fund crisis aid packages.

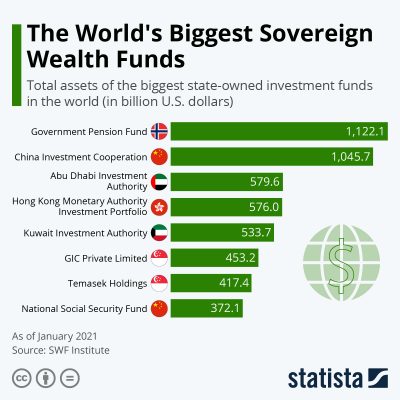

Figures released last week by the Sovereign Wealth Fund Institute show how Norway’s so-called “Oil Fund” is even bigger than China’s sovereign wealth fund and twice the size of Kuwait’s. The institute is a global organization designed to study sovereign wealth funds, pensions, endowments and other financial issues.

While the Corona crisis has devastated national economies around the world, and hurt Norway’s, too, the country’s Oil Fund earned a dizzying 1,070-billion Norwegian kroner last year. The Norwegian central bank’s unit that runs the fund, Norges Bank Investment Management (NBIM), could report an overall return on investment of 10.9 percent, and 12.1 percent on stock market investments alone. That amounted to the second-highest return since the fund’s first full year of investing in 1998.

The Oil Fund has thus provided the Norwegian government with the ultimate “piggy bank,” into which it can dip not only to annually augment the state budget but now, to compensate businesses and individuals for lost revenues and lost jobs during the Corona crisis. The government is usually restricted against withdrawing more than 3 percent of the fund’s asset size (viewed as the average return on assets) in order not to overheat the Norwegian economy. In 2020 it won approval to withdraw the equivalent of 3.3 percent (around NOK 300 billion), more in actual kroner than ever before but still relatively modest given the extent of the Corona crisis. And the near-record earnings on the fund of NOK 1,070 billion more than covered the withdrawal amount.

It also means Norway hasn’t had to borrow any money for its crisis aid packages, unlike most other countries. Finance Minister Jan Tore Sanner said last week, when unveiling the latest rounds of crisis packages, that Norway is “very, very lucky” to have the Oil Fund. Credit must also be given, however, to the top state politicians who had the foresight to set up the Oil Fund 25 years ago and save oil revenues for the day when Norway’s oil may run out or no longer be politically defensible in an era of climate change.

The Oil Fund’s prosperity is also tied to strong equity and real estate markets at a time of record-low interest rates. The crisis year of 2020 turned into the next-best in the Oil Fund’s history.

“Everything has gone the right way for the fund over 25 years,” its new chief executive Nicolai Tangen told newspaper Dagens Næringsliv (DN). He cautioned, though, that “we must be prepared that we won’t have the same sort of returns in the future that we’ve had in the past.” In the meantime, the first set of returns that he could report were satisfying indeed.

NewsInEnglish.no/Nina Berglund