An Oslo-based oil analyst thinks the price of a barrel of Norway’s North Sea crude will rise to well over USD 100 by summer, just as consumers are already seeing lots of other hefty price hikes, too. Inflation seems poised to return with a vengeance.

Monthly electricity bills in Norway have tripled or even quadrupled, petrol prices at the pump are often over NOK 20 per liter (more than USD 9 a gallon) and food prices have jumped in the past two weeks. It’s all raising howls of protests and raising concerns that it will spiral into demands for big pay raises this spring and a new period of inflation.

Norway’s consumer price index actually fell last month, from 5.3 percent in December 2021 to 3.2 percent in January 2022. That’s mostly because electricity rates soared to new heights in December, while they eased slightly last month, and prices for food and clothing did, too.

Double-digit increases now

On February 1, however, wholesalers and grocery store chains jacked up their prices, leading to some astonishing double-digit price hikes for everyday items like sandwich spreads, cheese, milk and coffee. Prices have risen so quickly, and so much, that the opposition in Parliament is demanding answers from the government minister in charge of agriculture and food.

“We welcome new players in the market, along with healthy and good competition,” MP Linda Helleland of the Conservative Party told Norwegian Broadcasting (NRK), “but we’re not sure the agriculture minister will contribute to that.”

Minister Sandra Borch of the Center Party, which firmly supports farmers and their demands for tariff protection, retorted that Helleland needn’t worry about the government’s concerns about a lack of competition within the grocery business. “The government is following the situation closely,” Borch told NRK.

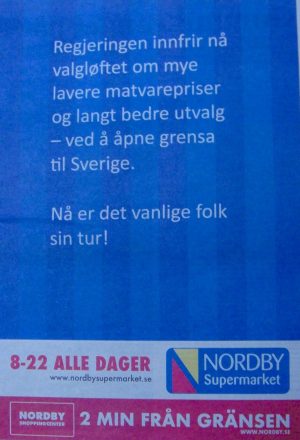

Shopping centers in Sweden, meanwhile, were advertising in Oslo-area newspapers this week, welcoming Norwegians to drive over the border and enjoy much better selection at lower prices. Nearly 65,000 did just that right after Norway withdrew most all of its Corona-related restrictions on travel. While inflation is setting in all over the world, Swedish price levels remain lower than Norway’s, especially after the price hikes this month.

Consumers in Norway are wondering why some products have gone up as much as 20 percent or more, and why all three major grocery retailers landed at roughly the same prices. MP Torgeir Knag Fylkesnes of the Socialist Left Party (SV) suspects “coordinated price-setting in the grocery market, which is illegal. We can’t live with this.”

Grocery retailers NorgesGruppen, REMA and Coop, known for being controlled by some of Norway’s wealthiest families, firmly deny price-setting and claim competition amongst them is strong. Wholesalers also plead innocent, with food producer Orkla even warning of more price hikes to come. It blames high energy costs, uncertainty tied to the value chain and higher transport and logistics costs tied to the Corona crisis. “Orkla is exposed to higher costs for vegetable oil, grain, meat, vegetables and dairy products, where there have been big price hikes,” the company wrote in its latest quarterly report released last week. When its costs go up, Orkla passes them on, while also still reporting another increase in profits. Grocery chains are also known for being highly profitable while farmers constantly complain their share of the supply chain is way too low.

It’s the energy prices for oil, gas and electricity that are hitting everyone hard, and it’s bound to get worse. Analyst Nadia Martin Wiggen of Pareto Securities in Oslo predicts oil will be trading at around USD 110 a barrel by June, even if Iran rejoins the market, and USD 125 a barrel if not. If Russia invades Ukraine, the price rise will be even greater, as seen earlier this week when oil was already trading, if briefly, above USD 100 before falling back and settling in the mid-USD 90s.

The higher energy prices, especially for electricity and gas, will be passed on to consumers, who also will be likely to agitate for higher salaries, setting off what some economists fear will be an inflationary spiral. As an oil producer, high oil prices are always good for Norway’s national economy but not for “ordinary people” suddenly facing higher prices for just about everything as the Corona crisis eases, society opens up again and pent-up demand is also outstripping supply in many areas.

Norway’s national organization for the banking and finance industries, FinansNorge issued its first-quarter barometer this week, reporting that Norwegians still have high expectations for the Norwegian economy. It has also recovered quickly after the Corona crisis. Optimism, however, is lower than it was in the previous quarter, especially among those with relatively low incomes.

“A quick revival of Norwegians’ expectations for the future has been replaced by dampened optimism,” stated Finans Norge’s leader Idar Kreutzer. “A combination og high electricity bills and higher interest rates for those with mortages has probably contributed to that.”

Alarm bells have already been ringing at Norway’s central bank, which already has raised interest rates twice and is expected to do so five times more over the next two years. That’s going to add more to the costs of households with big mortgages. Interest rates must go up, Norges Bank reasons, to keep price growth down.

newsinenglish.no/Nina Berglund